Ways to Give

Establish an Endowment

Establishing an endowment is a great way to leave a legacy in the Church for a specific purpose that you would like to support in perpetuity.

You can establish an endowment fund at the foundation with a minimum of $5,000. Once the fund reaches $50,000 it is eligible for an annual distribution designated for its gift purpose.

If you are interested in establishing an endowment, we’d love to talk with you.

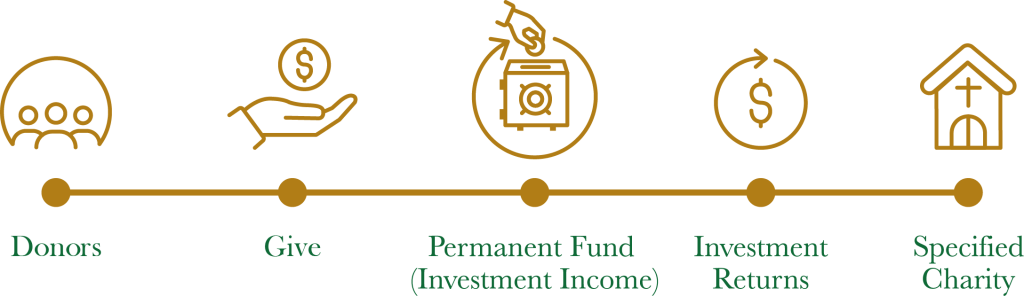

How does an Endowment work?

- Outline your personal philanthropic goals.

- Determine how much you wish to invest now and/or through a simple designation in a will or trust to establish a charitable fund.

- Name the fund and name the fund’s advisors.

- Work with East Texas Catholic Foundation to determine the spending policies for the fund.

- Establish your fund with an initial gift and/or translate your charitable intentions into a lasting legacy through your will or trust.

Donate to an Existing Fund

You can send a gift to any of our existing funds with a minimum donation of just $25.

Gifts to existing endowments can be one-time or recurring. If you aren’t sure which option is best for you, contact us, and one of our associates will be happy to walk you through your options.

Many parishes in the Diocese of Tyler – as well as other Catholic charity organizations – already have established funds should you wish to donate directly to your parish.

Stocks and Property

Donating long-term assets is a great way to ensure stable financial support for the fund of your choice.

Long-term assets – especially highly appreciative securities – can be a much more tax-friendly choice than donating cash.

Stocks and property also tend to offer better long-term support for the fund you’re donating to.

We recommend that you don’t sell your securities to generate cash donations. Gifting these securities directly increases your gift amount as well as your potential tax deduction.

The Legacy Society

The Legacy Society promotes planned giving in the hopes that gifts secured today will preserve our Catholic heritage and ensure everlasting giving for the future.

The Society acknowledges those families and individuals who create a legacy gift to either their home parish or the East Texas Catholic Foundation itself.

If you would like to leave a legacy gift, we can give you resources to leave a lasting legacy.

Become a Member of the Legacy Society

To become a member of the Legacy Society, simply let the East Texas Catholic Foundation know in writing that you have named a parish, school, agency, or the Foundation in your estate plan.

That can be done through a bequest, trust, life insurance, or retirement plan beneficiary designation.

You are also invited to become a Legacy Society member if you have established an endowment fund in full at the Catholic Foundation.

Invest in Your Faith Today

We’re here to help you financially support the best Catholic charity or fund for your donations.

If you want to support this East Texas Church community, but don’t know exactly how, we’re here to help.

Contact the East Texas Catholic Foundation today to talk about your planned or one-time giving options.